Global

- SBTi’s Enhanced Standards: The Science Based Targets initiative (SBTi) has been leading the way to a net-zero economy, boosting innovation and drive sustainable growth by helping organization set their ambitious, science-based emissions reduction targets, and has supported GHG Protocol’s approach to carbon accounting. The recent inclusion of carbon offsets (specifically “environmental attribute certificates”) as an option to hit SBTi targets was both a surprise to many, and then quickly reversed after internal uproar, which shows the global pressures from businesses to provide easy paths and flexibility in addressing these emissions. SBTi has now been both praised and critiqued, and I think it’s been an interesting story to watch as it really reflects the pressures on both sides. More to unfold when a draft proposal is set to be released in July.

- LEED v5 for public comment: The draft of LEED v5 marks a significant advancement in the LEED standards, pushing forward sustainable buildings. This new version is now out for public comment, and has made a significant emphasis on decarbonization. LEED v5 aims to set a higher benchmark for energy efficiency and ecological design globally. LEED v5 certainly marks a big shift for USGBC as it seeks to address some of the criticism on LEED’s ability to address climate change, and I encourage everyone to comment, or check out comments that our team will be making publicly soon.

Europe

- EU EPBD Directive: Central to Europe’s climate strategy, the EU officially announced that they have formally adopted the revised Energy Performance of Buildings Directive (EPBD). The EPBD is instrumental in reducing the energy usage of buildings across the EU and promoting the adoption of renewable energy, therefore contributing significantly to the EU’s goals of reducing greenhouse gas emissions and enhancing energy independence. Building owners are urged to stay abreast of these regulations, as compliance is essential for new constructions and major renovations.

North America

- CRREM Guidelines in NA: The Climate Risk Real Estate Monitor (CRREM) is formulating precise guidelines for North America, delineating carbon reduction pathways that align with global climate targets. Our team at Autocase has been fortunate to join the “who’s who” in sustainability in NA in the CRREM workshops. Overall, ULI and the CRREM group have shown significant effort to pull the best possible data approach to baselining and predicting what buildings need to achieve in order to hit Paris-aligned targets, and I personally applaud the level of detail and analysis that’s gone into this work. Public comment is now open!

- SEC Ruling: The Securities and Exchange Commission (SEC) has introduced new regulations that enhance the transparency of climate risks in financial reporting by publicly traded companies in the U.S. These rules mandate that large publicly traded companies disclose their direct greenhouse gas emissions when these are considered “material” to investors. Starting in 2026, companies identified as “Accelerated filers” must also report their Scope 1 and 2 emissions, based on data from 2025. This move is designed to provide investors with clearer insights into the environmental risks associated with their investments, thereby facilitating more informed decision-making regarding climate-related risks. The disappointment was from the lack of Scope 3 reporting and some of the watering down, and the impact on these changes will be something to watch as the US gets ready for its next election.

- Blueprint for Decarbonizing US Buildings: The “Blueprint for Decarbonizing US Buildings” from the US government, provides comprehensive strategies aimed at reducing carbon emissions from the building sector across the United States. It details a variety of approaches, including enhancements in energy efficiency and the adoption of innovative building materials. This document is the first of its kind and is essential for stakeholders aiming to align with national carbon reduction goals and can typically be accessed through environmental policy organizations or relevant governmental websites focused on energy. I encourage you to check it out if you haven’t already!

At the Local Level

- City of Vancouver, Canada BEPS: The City of Vancouver has introduced Annual Greenhouse Gas and Energy Limits bylaw that require GHG emissions disclosures, which is first of it’s kind in Canada, and will come into effect on June 1. Fines will begin in 2026, as the city is pushing building owners to significantly reduce energy consumption and greenhouse gas emissions. (Small anecdote is that for some years, these regulations are the only ones more strict than CRREM’s guidance.) The initiative is part of Vancouver’s broader strategy to enhance urban sustainability and meet its climate objectives, highlighting the City’s commitment to net zero. Very impressive!

Conclusion

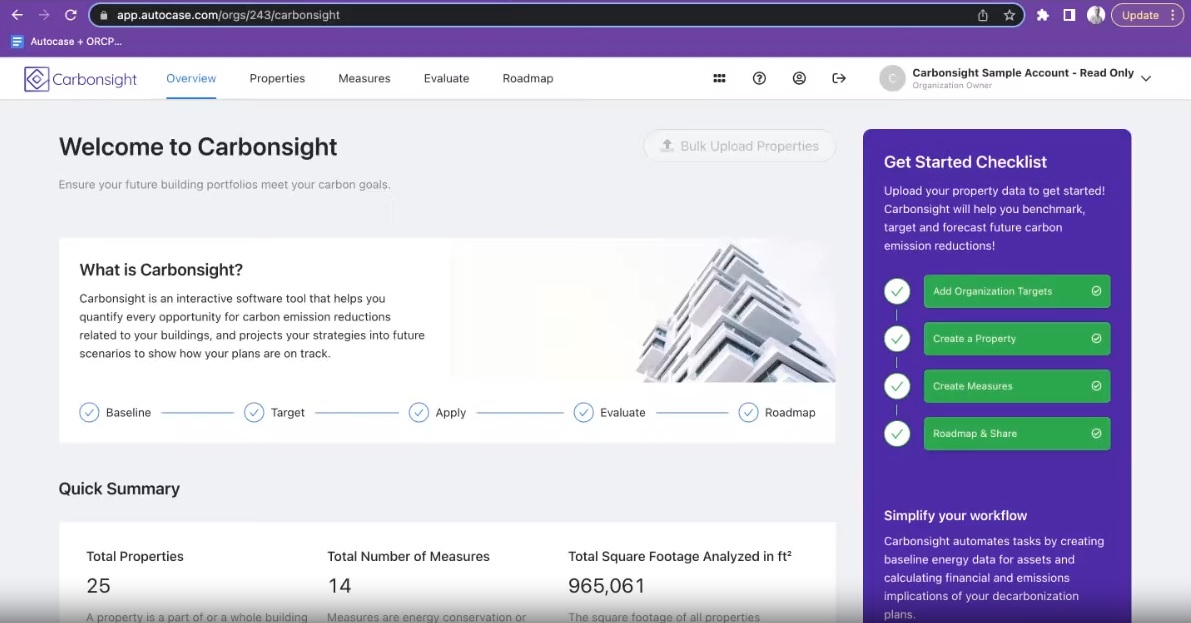

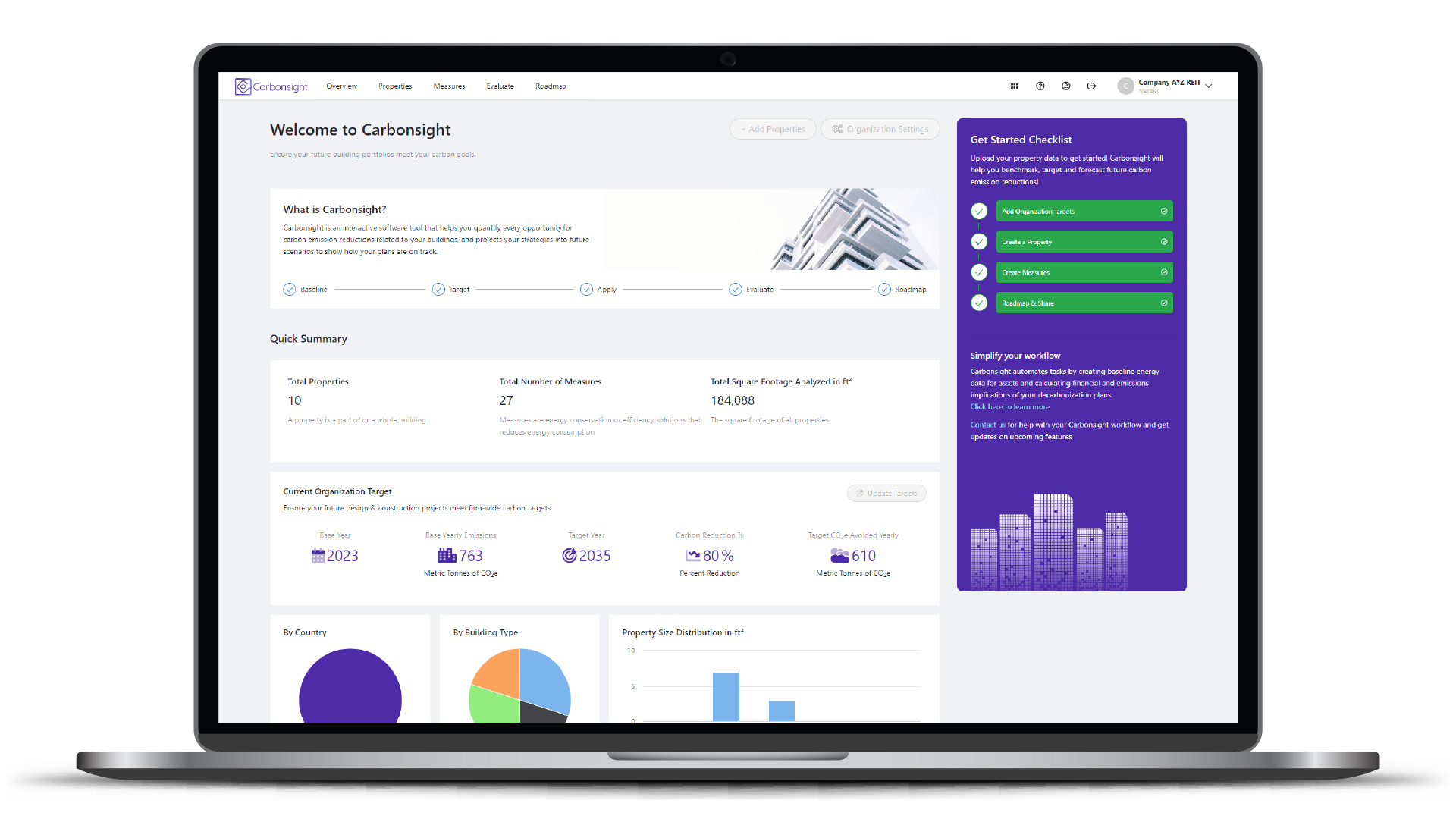

We know the market is changing fast, and this is something that we at Carbonsight do our best to stay on top of! Carbonsight by Autocase offers essential solutions for hitting the increasingly strict environmental regulations. Its robust analytics evaluate the financial and carbon impacts of building projects under new regulatory pressures. By leveraging such tools, businesses can optimize strategies to meet sustainability requirements, positioning themselves favorably in a market valuing green initiatives and hitting carbon targets. Embracing these technologies not only ensures compliance with legislative changes but also leads the transition towards a sustainable and resilient future.

If you are interested in learning more about decarbonizing your real estate portfolio and want to earn 1 CE credit, check out: https://www.usgbc.org/education/sessions/blueprint-decarbonize-your-real-estate-portfolio-12857254